Selangor High-Rise Residential Property: What the Sales Reveal (2015–2025)

- Source: NAPIC (2015 - 2025, up to September)

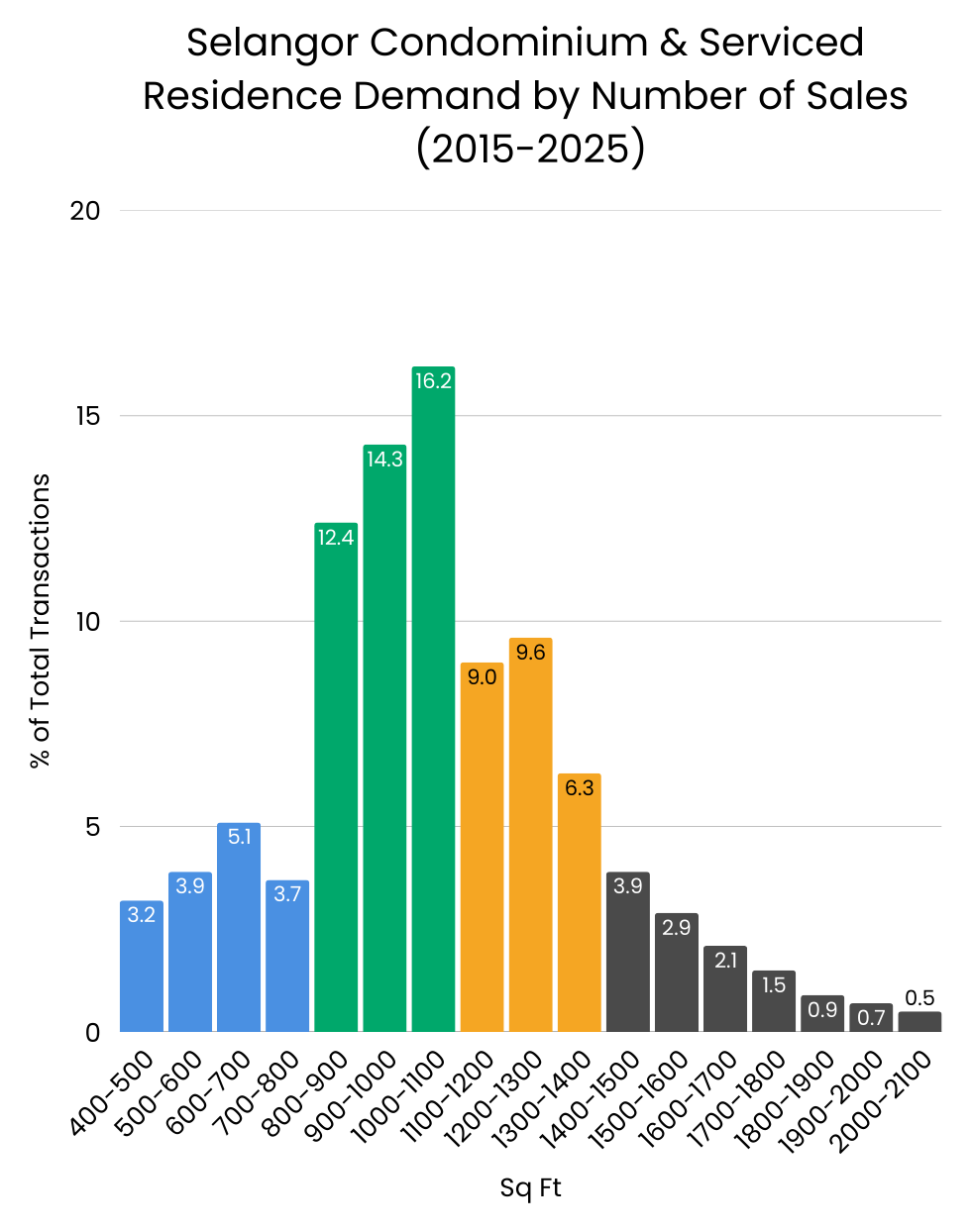

Key Takeaways: Selangor Condominium & Serviced Residence Size Demand

1) 800 – 1,400 sq ft dominates Selangor’s high-rise market.

- This combined range makes up 67.8% of all transactions. Units below 800 sq ft form 15.9%, while sizes above 1,400 sq ft represent a progressively smaller portion of the market.

2) Units below 800 sq ft represent a niche buyer segment.

- They cater mainly to singles, young working adults, or investor-type purchases, reflecting a more specialised market.

3) The 800 – 1,100 sq ft range is the most versatile and widely demanded.

- Its strong appeal comes from its practicality for singles, couples, and small families—making it the most adaptable high-rise product.

4) The 1,100 – 1,400 sq ft category accounts for 24.9% but is more selective.

- These larger layouts mainly attract families seeking additional space. Demand is healthy but more dependent on location and price.

5) Sizes above 1,400 sq ft remain niche and lifestyle-oriented.

- They attract space-focused households, but transaction activity stays low due to higher prices and limited supply.

- Source: NAPIC (2015 - 2025, up to September)

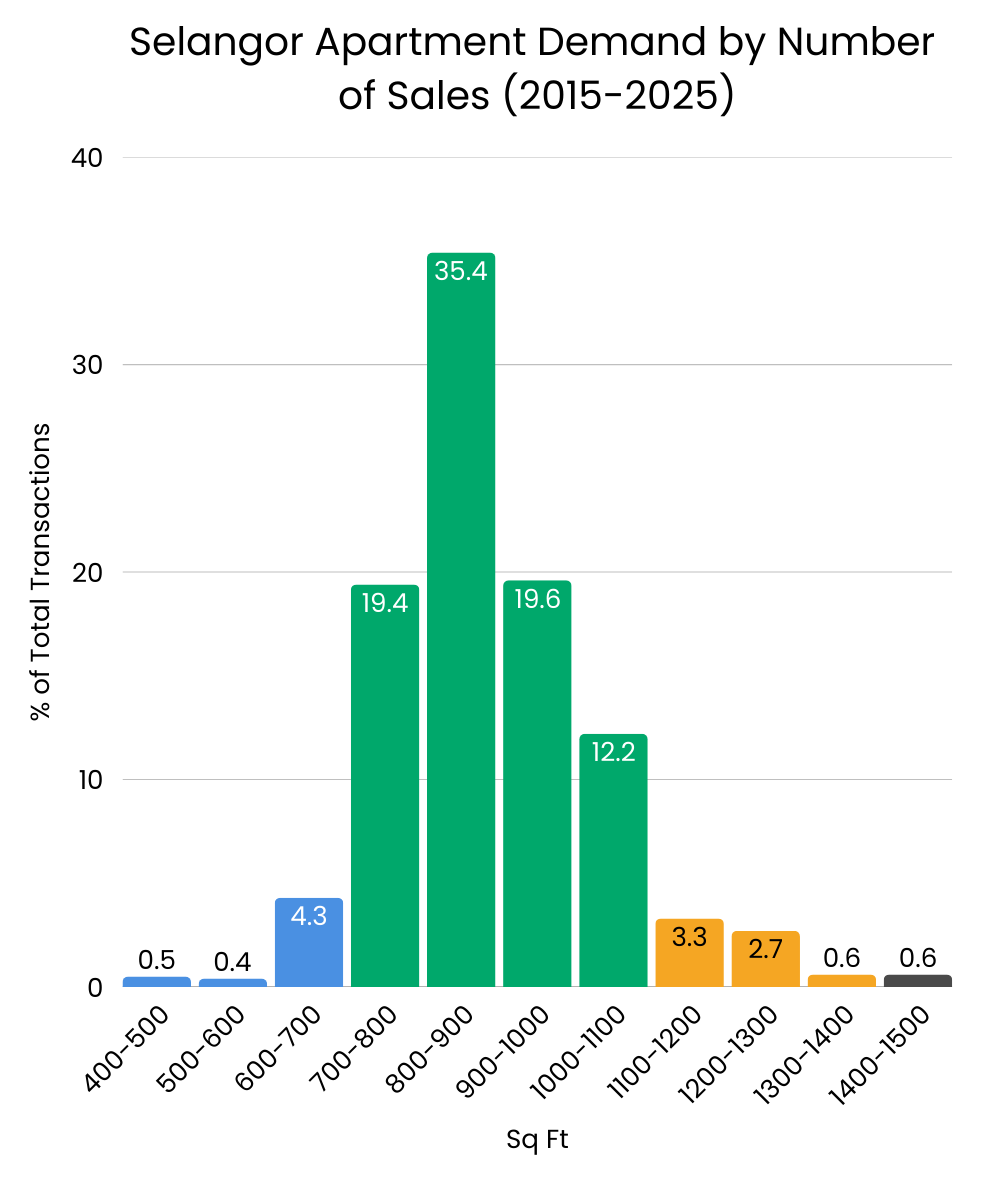

Key Takeaways: Selangor Apartment Size Demand

1) Market activity is heavily concentrated in the 700 – 1,100 sq ft range.

- This reflects the nature of Selangor’s apartment stock, where most units were built in this size band and new supply in other ranges remains limited.

2) This segment primarily supports the affordable housing market.

- Buyers in this category tend to prioritise practicality and value, making mid-sized units the natural choice for many households.

3) The apartment market serves a broad mix of purchasers and renters.

- Its price accessibility and practical layouts attract diverse groups — including first-time buyers, young families, and long/short term tenants.

Overall Market Insights

1) Demand for high-rise residential properties in Selangor naturally revolves around size ranges that suit both everyday living and investor affordability.

- These are units where singles, couples, and small families can live comfortably, while also sitting within the price bracket that most entry-level investors can afford to purchase.

2) This core band — typically around 800–1,100 sq ft — offers the strongest balance of affordability, usable space, and long-term liquidity.

- Across 2015–2025, it consistently remains the most active and adaptable segment of the high-rise residential market.

3) Size ranges outside this core band tend to serve more specific buyer groups, resulting in naturally lower transaction activity.

- Very small and very large units still play important roles, but their demand profiles are narrower.

Property Valuation and Market Consultancy in Selangor

Our team provides property valuation and market consultancy services in Selangor, supporting bank loan valuations, refinancing, purchase and sale decisions, audit requirements, and development feasibility studies.

If you require a property valuer in Selangor or would like to discuss a valuation or market study, feel free to contact our team for a preliminary discussion.

Disclaimer:

This document, created by City Valuers & Consultants, is intended for general informational purposes only and does not establish any advisory, fiduciary, or professional relationship. While based on established methods, it is not a definitive forecast, appraisal, or valuation, and we make no warranties or representations as to the data's current accuracy or completeness. The data presented includes third-party information, which could contain inaccuracies or be outdated, and has not been independently verified. We disclaim liability for any errors, omissions, or inaccuracies and any loss or damage arising from reliance on this information.