Klang Valley Property: Why Timing and Pricing Matter More Than Location

Market Conditions Set the Cycle in Motion

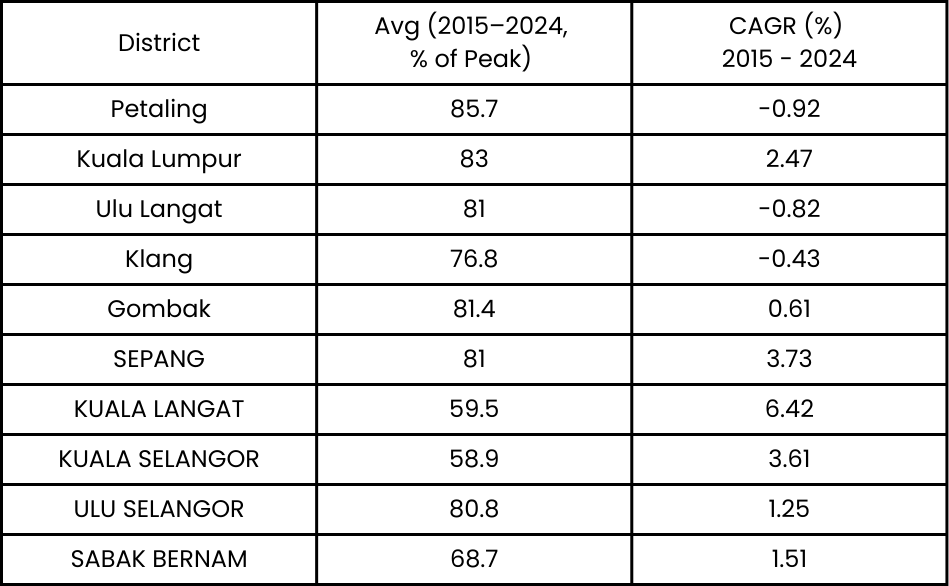

- All figures represent the number of recorded transactions across Residential, Commercial, and Industrial properties from NAPIC data. These counts are normalised to each district’s peak year (set to 100%) to enable fair comparison across districts and over time. For example, a value of 80% indicates transaction activity was 20% below the district’s peak level.

- Across all districts, transaction activity peaked between 2021 and 2023 — a period marked by post-pandemic stimulus, government incentives, and historically low interest rates — showing that transaction surges were driven by favourable market conditions rather than location alone.

Liquidity Is About Consistency

- Avg (2015–2024, % of Peak) shows how consistently active each district has been relative to its peak year — higher averages indicate deep, stable liquidity, while lower averages reflect thinner, more uneven demand despite periods of growth.

- CAGR (2015–2024) highlights where transaction activity has grown over time; positive CAGR reflects structural expansion from lower bases, while near-zero or negative CAGR indicates transaction activity reverting toward long-term norms rather than expanding further.

Timing & Entry Price Create Returns

- Market timing can outweigh location effects

- Across all districts, transaction activity peaked between 2021–2023 when interest rates were low and government incentives were present, showing that favourable market conditions can lift transaction volumes across the board — not just in prime locations.

- Across all districts, transaction activity peaked between 2021–2023 when interest rates were low and government incentives were present, showing that favourable market conditions can lift transaction volumes across the board — not just in prime locations.

- In markets with consistently high activity, price matters more than location

- Districts with high Avg (2015–2024) activity indicate buyers have many options, which naturally leads to competitive pricing. In such markets, meaningful ROI is achieved primarily by entering below fair market value or owning a unit that stands out clearly from comparable options (in condition, layout, or rental appeal) — ideally both — as these factors create margin regardless of location.

- Districts with high Avg (2015–2024) activity indicate buyers have many options, which naturally leads to competitive pricing. In such markets, meaningful ROI is achieved primarily by entering below fair market value or owning a unit that stands out clearly from comparable options (in condition, layout, or rental appeal) — ideally both — as these factors create margin regardless of location.

- Growth markets are driven more by timing than immediate liquidity

- Districts such as Kuala Langat and Kuala Selangor, where average activity remains low but long-term growth is positive, show that transaction volumes can expand further over time, making returns more sensitive to when one enters the market rather than how established the location is today.

- Districts such as Kuala Langat and Kuala Selangor, where average activity remains low but long-term growth is positive, show that transaction volumes can expand further over time, making returns more sensitive to when one enters the market rather than how established the location is today.

- Underperformance often comes from misreading the market context

- Applying growth-market expectations to mature areas — or expecting mature-market liquidity in early-stage districts — leads to disappointment; strong outcomes come from aligning location with the right price in established markets, and with the right timing in developing ones.

- Applying growth-market expectations to mature areas — or expecting mature-market liquidity in early-stage districts — leads to disappointment; strong outcomes come from aligning location with the right price in established markets, and with the right timing in developing ones.