Fair Value of Property, Plant and Machinery

Fair Value Standards

A) When undertaking valuations for Financial Reporting purposes in Malaysia, the Malaysian Valuation Standards States that the Valuer must have a clear understanding of the accounting measurement requirements and valuation techniques accepted, and accounting policies and disclosure required under the relevant Malaysian Financial Reporting Standards (MFRS), Malaysian Private Entities Reporting Standards (MPERS), the Malaysian Valuation Standards (MVS) and the International Valuation Standards (IVS).

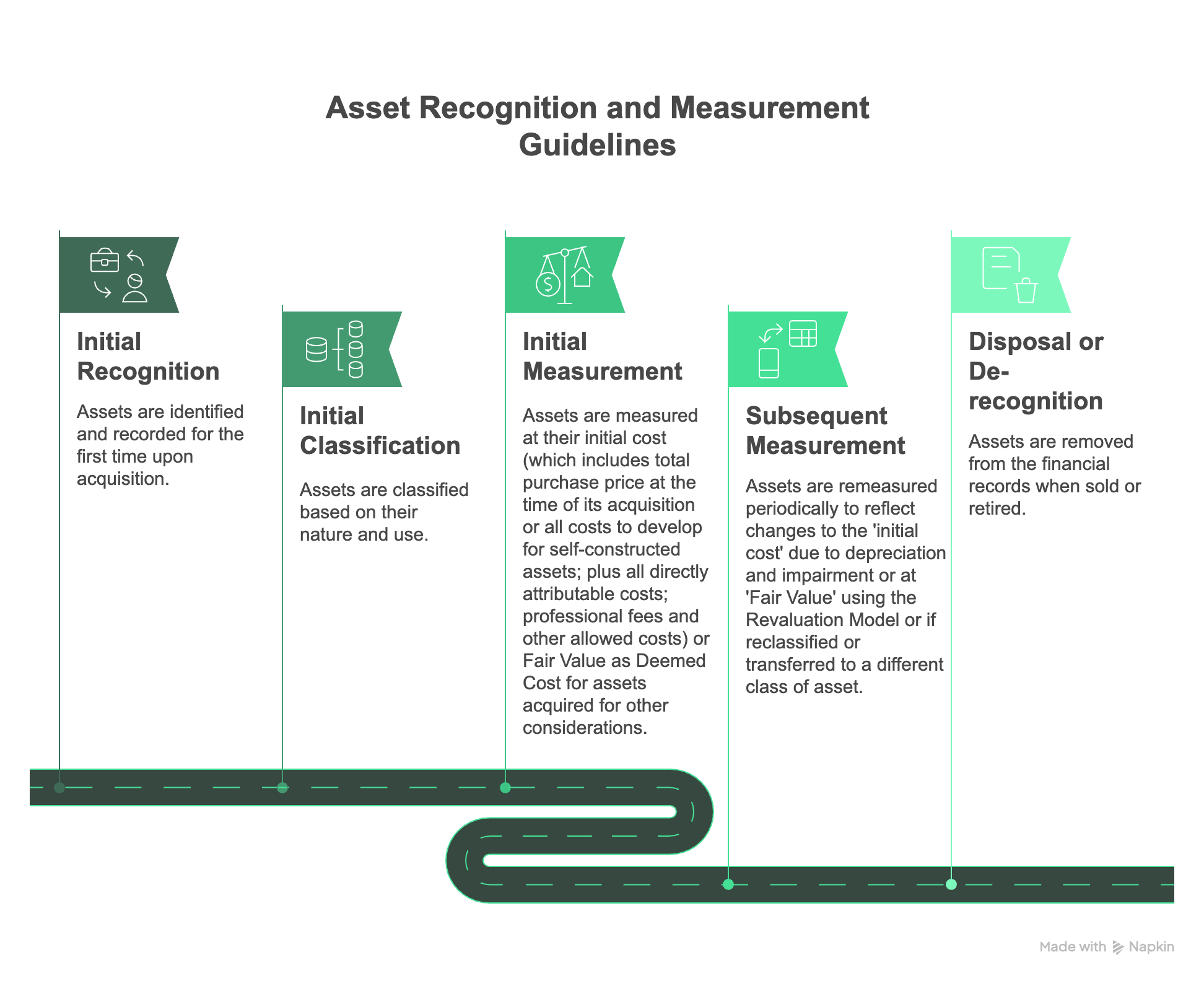

B) The MFRS and MPERS have definite set of rules on how and when assets are to be recognised, classified, measured initially and measured subsequently until disposal or de-recognition. ‘Fair Value’ measurement applies to both initial and subsequent measurement if Fair Value is required or permitted by the MFRS.

C) Fair Value in MFRS refers to a market based measurement of ‘the price that would be received to sell an asset (or paid to transfer a liability) in an orderly transaction between market participants in the principal (or most advantageous) market at the measurement date under current market conditions (i.e. an exit price from the perspective of a market participant that holds the asset) regardless of whether the price is directly observable or estimated using an acceptable and appropriate valuation technique.’

Entities do not necessarily sell assets (exit price) at the prices paid to acquire them (entry price).

Fair Value Measurement

Highest and Best Use

D) The ‘Fair Value’ measurement must take into account a market participant’s ability to generate economic benefits by using the asset in its highest and best use or by selling it to another market participant that would use the asset in its highest and best use. The highest and best use of the asset must take into account that the use is physically possible, legally permissible and financially feasible. When measuring Fair Value, the pertinent characteristics of the asset such as its condition, location, restrictions if any on the sale or use of the asset, must be taken into account. The Fair Value shall also not be adjusted for transaction costs since transaction costs are not a characteristic of an asset.

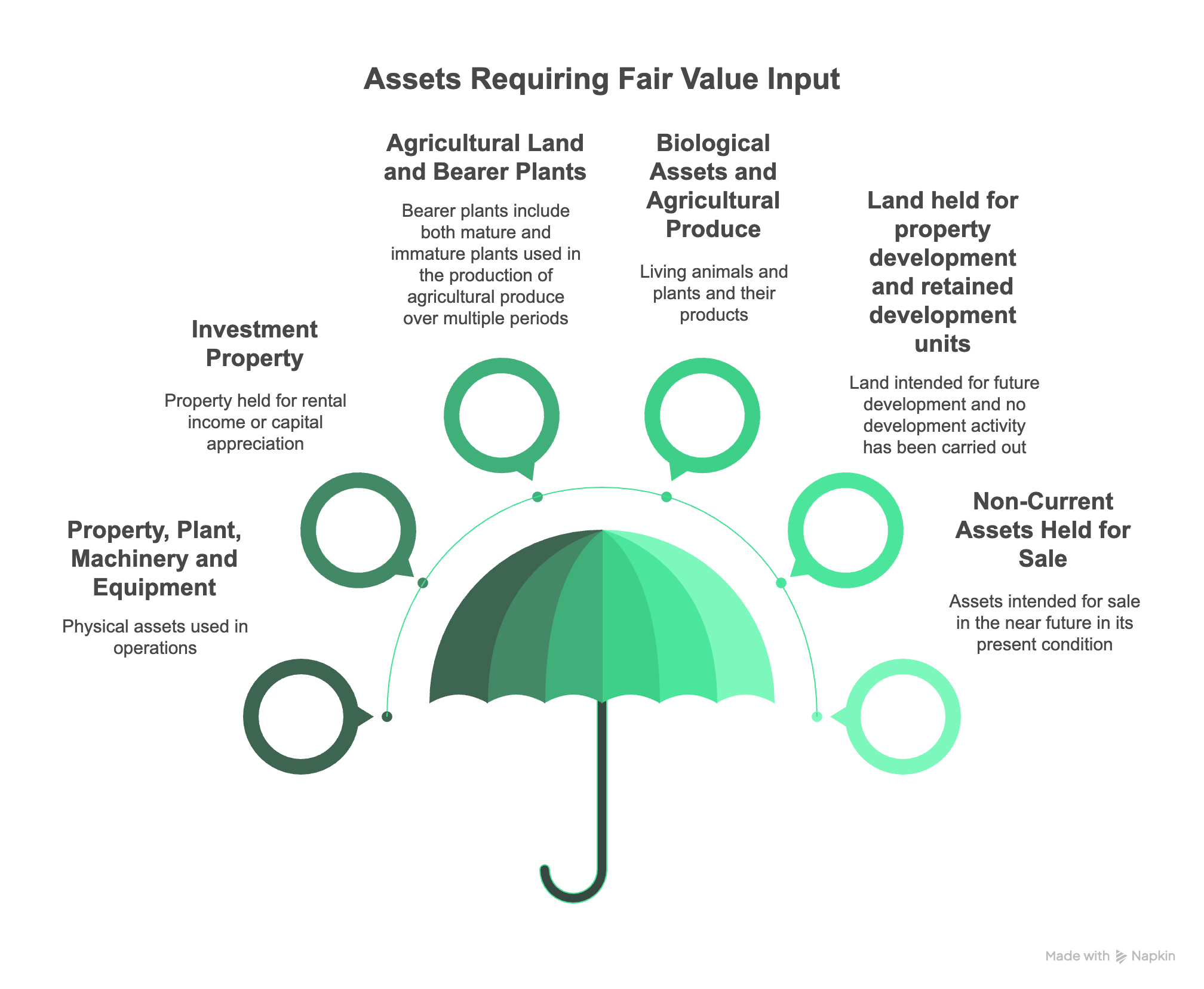

E) The assets in a typical Financial Position Statement of a company which may require the Fair Value input from a valuer include the following:-

- Property, Plant, Machinery and Equipment

- Investment Property

- Agricultural Land and Bearer Plants

- Biological Assets and Agricultural Produce

- Land held for property development and retained development units

- Non-Current Assets Held for Sale

Fair Value Input

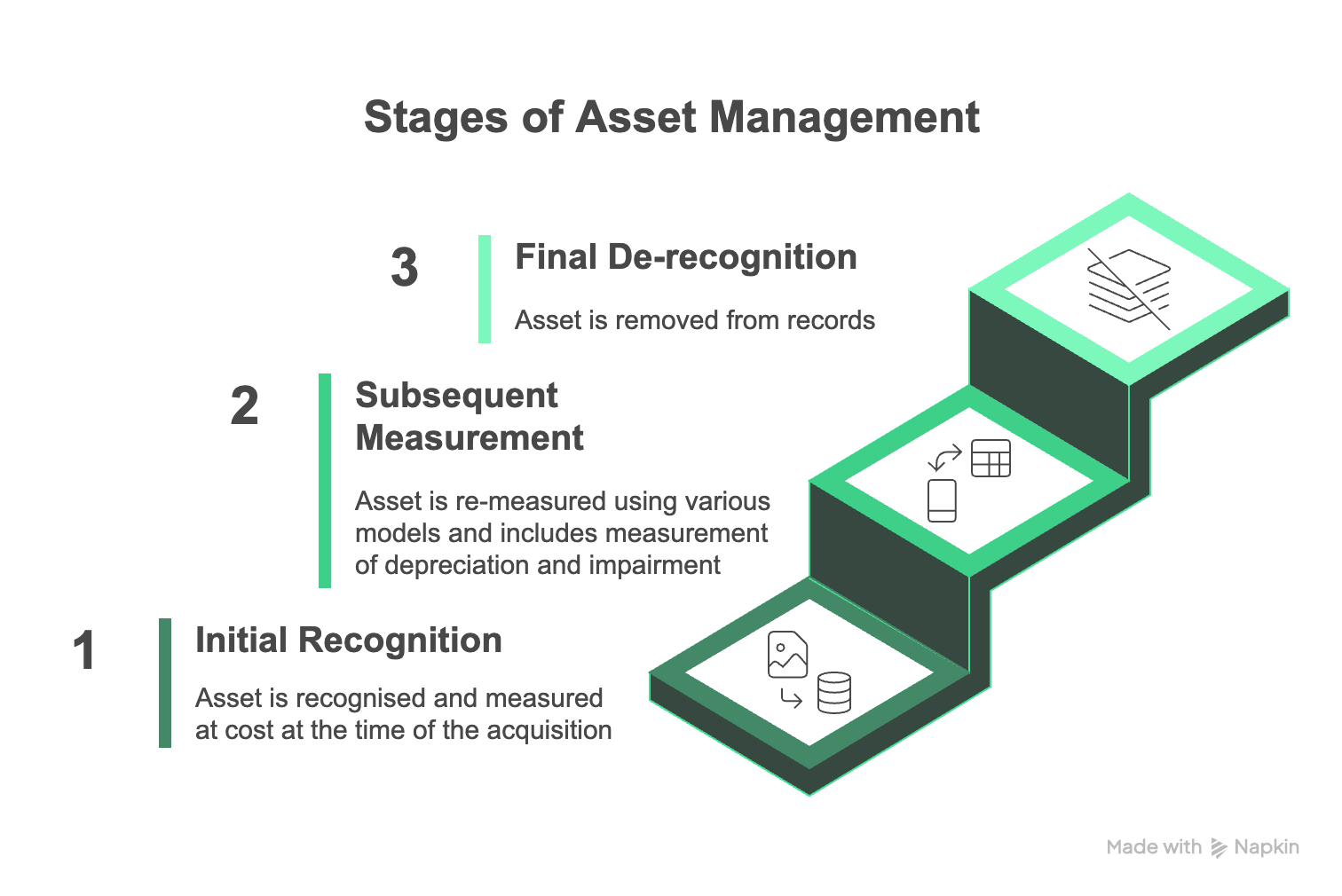

Property, Plant and Machinery Recognition Stages

F) All Property, Plant, Machinery and Equipment upon recognition have 3 stages.

- Initial Stage

- Recognised as an asset

- Classified

- Measured at Cost or Fair Value as Deemed Cost

- Subsequent Stage (Re-measured using)

- Cost Model

- Revaluation Model

- Fair Value Model

- Final Stage

- De-recognised as an asset

Methods of Valuation of Fair Value

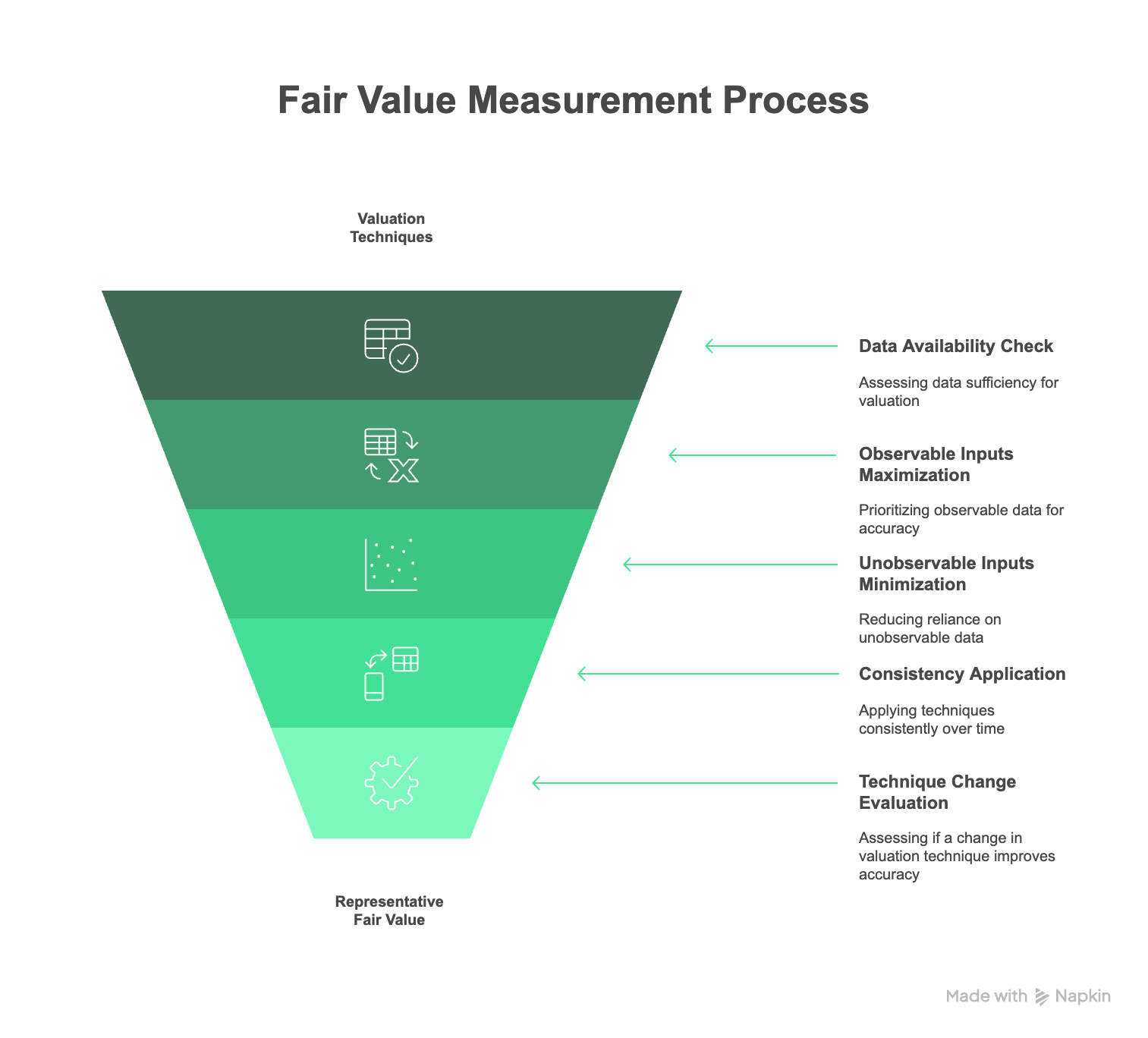

G) MFRS 13 states that ‘an entity shall use valuation techniques that are appropriate in the circumstances and for which sufficient data are available to measure Fair Value, maximizing the use of relevant observable inputs and minimizing the use of unobservable inputs.’ The valuation techniques used to measure Fair Value shall be applied consistently. However a change in valuation technique is appropriate if the change results in a measurement that is more representative of Fair Value in the circumstances.

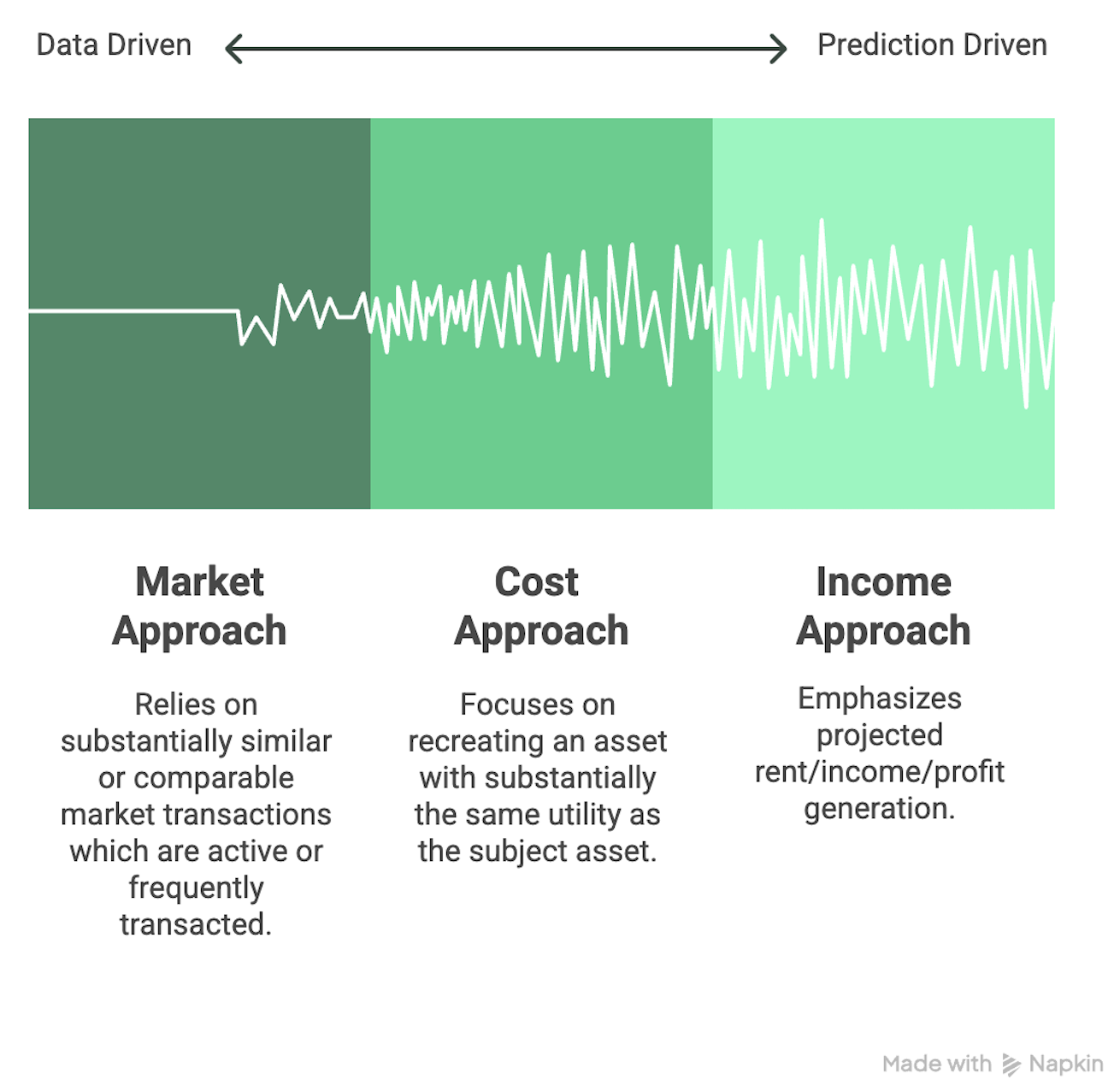

- Market Approach

- Direct Capital Comparison Method

- Land & Building Comparison Method

- Market Comparison Method

- Cost Approach

- Contractors Cost Method (Reproduction Cost Method)

- Cost Plus Method or Summation Method

- Depreciated Replacement Cost Method

- Income Approach

- Investment/Income Capitalisation Method

- Discounted Cash Flow

- Profits Method

- Residual Method

Advantages of Fair Value Measurement Compared to the Cost Model

- Usefulness to owners and investors to make sound economic decisions

- Facilitates objective cross border transactions on a comparable basis

- Captures all changes in market values over different time periods and economic conditions

- Fulfils Disclosure Requirements of MFRS

- Distinguishes value from cost

- Indicates Highest and Best Use and prudent resource allocation

- Enables annual Impairment Review

Choice of Method of Valuation

The Market Approach is used if

- the subject asset has recently been sold in a transaction

- the subject asset or substantially similar assets are actively publicly traded and

- there are frequent and/or recent observable transactions in substantially similar assets.

The Cost Approach is used if

- participants would be able to recreate an asset with substantially the same utility as the subject asset without regulatory or legal restrictions and

- the asset is not directly income generating and the unique nature of the asset makes using the income approach or market approach unfeasible.

The Income Approach is used if

- the income / rent / profit producing ability of the asset is the critical element affecting value from a participant perspective and

- reasonable projections of the amount and timing of future income / rent / profit are available for the subject asset.

Fair Value of PME

The methods of valuation for PME are similar to property but additionally when valuing PME, the valuer must state the ‘premise’ on which the basis of valuation is made.

- That the PME assets are valued as a whole for use in its working place as part of an operating business.

- That the PME assets are valued as a whole, in place, but on the assumption that the business is closed.

- That the PME assets are valued as a whole, in place but on the assumption.

- That the PME assets are valued as a whole for removal from the premises.

- That the PME assets are valued as individual items or piecemeal for removal from the premises at the expense of the purchaser or vendor.

Generally building services such as electrical wiring and fittings, water piping and fittings, air conditioning and ventilation piping and fittings, fire and security fixtures and fittings, lifts and gantries, etc. which are normally deemed as building services are valued as part of the building by valuers.

The valuer must also determine whether the structures / installations erected to shelter the PME is recognised as buildings or PME in the accounts by the entity and follow the same classification in the valuation.

Plant, Machinery, and Equipment Valuation 'Premise'

Fair Value Approaches of Valuation for PME

The Market Approach is used for classes of PME that are homogenous, e.g. motor vehicles and certain type of industrial machinery for which there is sufficient data of recent sales of similar assets. Usually PME of non-investment character but having marketability as its attributes are valued by this approach.

The Income Approach is based on the concept that the value of the PME is directly related to the earnings that the owner / buyer expects to receive in the future over the remaining economic life of the PME in continuous operations. Two methods of valuation can be used under this approach i.e. the capitalisation of earnings method and the discounted cash flow method. If the PME is used in combination with land and buildings, then the value of the PME is segregated from the Aggregate Market Value of the combined group of assets derived by the Income Approach, by deducting the market value of the land and building components which are determined by other methods of valuation.

The Cost Approach is used commonly for PME that are not frequently exchanged in the market. From the perspective of a market participant seller, the price that would be received for the PME is based on the cost to a market participant buyer to acquire a substitute asset of comparable utility, adjusted for obsolescence. It is also used for ‘new’ PME and ‘specialised’ PME. Its main advantage lies in the fact that it provides specific asset identification, asset inclusions and exclusions and depreciation for each asset.

General Features and Factors taken into consideration in using the Market Approach

- Market conditions at time of sale of comparables and date of valuation

- Access and location factors and frontage to main roads

- Construction cost differences

- Condition of buildings, age of buildings, state of repair / disrepair / quality and cost of property management

- mprovements and extensions

- Floor area, floor level, view

- Height of building to eaves, ridge and ceiling levels

- Floor loading capacity

- Size, shape and contour of site

- Legal conditions / restrictions / FH/LH tenure / remaining tenure

- Economic factors / surrounding developments /supply and demand

- Town planning conditions and requirements / premium payments / allowed densities / plot ratios / height restrictions /etc.

- Profitability and/or market rent from the assets

- Terms and conditions in the sale and purchase of the comparable transactions, deferred payments, discounts, rebates, etc.

- Historical and expected growth

- Marketability factors

- Comparable sales may be between related parties, under duress or under special circumstances

General Features and Factors taken into consideration in using the Cost Approach

- Direct current costs of construction or acquisition (which may be actual cost of subject asset or a directly comparable reference asset cost).

- Preliminaries, statutory contributions, local authority submissions, site works, infrastructure works, piling works, car parks, facilities, amenities, site improvements and landscaping, fencing, gates, security systems, etc.

- Indirect Cost

- professional fees

- borrowing costs

- time cost

- profit margin

- Age of asset

- Depreciation due to age and method of depreciation.

- Physical Obsolescence due to condition and costs to cure the deterioration.

- Functional Obsolescence due to loss of utility or efficiency.

- Economic Obsolescence due to economic / locational / demand factors.

- Useful life / economic life / residual value.

General Features and Factors taken into consideration in using the Income Approach

- Gross contractual income / reversionary rent and variable income / market rental value.

- Cost of outgoings / operating costs to owner that will be required to be spent to generate the gross income.

- Service charges for common property.

- Net rent / net market rental value / fair maintainable operating profit / EBITDA.

- Tenure of tenancy/ lease/ land title.

- Voids / vacancies / rent free incentives.

- Income capitalization yield (which is market derived and adjusted for risk of subject asset).

- Discount rate (based on return expected from similar investments / or build-up from a safe risk free yield).

- Market risk associated with the property or industry.

- Potential growth in the income / rent / revenue / outgoings.

- Sinking fund / capital replacement fund / refurbishment fund.

- Management cost (base and incentive fee).

- Divisible balance / tenant’s share / interest on tenant’s capital.

- Built-up floor area / lettable area / car park area / facilities and amenities area.

- Terminal value / residual value / salvage value.